When you pick up a generic pill at the pharmacy, you probably don’t think about how it got there. But behind that simple transaction is a high-stakes game of economics, logistics, and risk management. Generic drugs make up over 90% of prescriptions in the U.S., yet they account for just 20% of total drug spending. That’s the paradox: they’re cheap, but keeping them in stock is anything but easy. Supply chain efficiency in generic drug distribution isn’t about cutting corners-it’s about surviving on razor-thin margins while avoiding dangerous shortages.

The Cost of Being Cheap

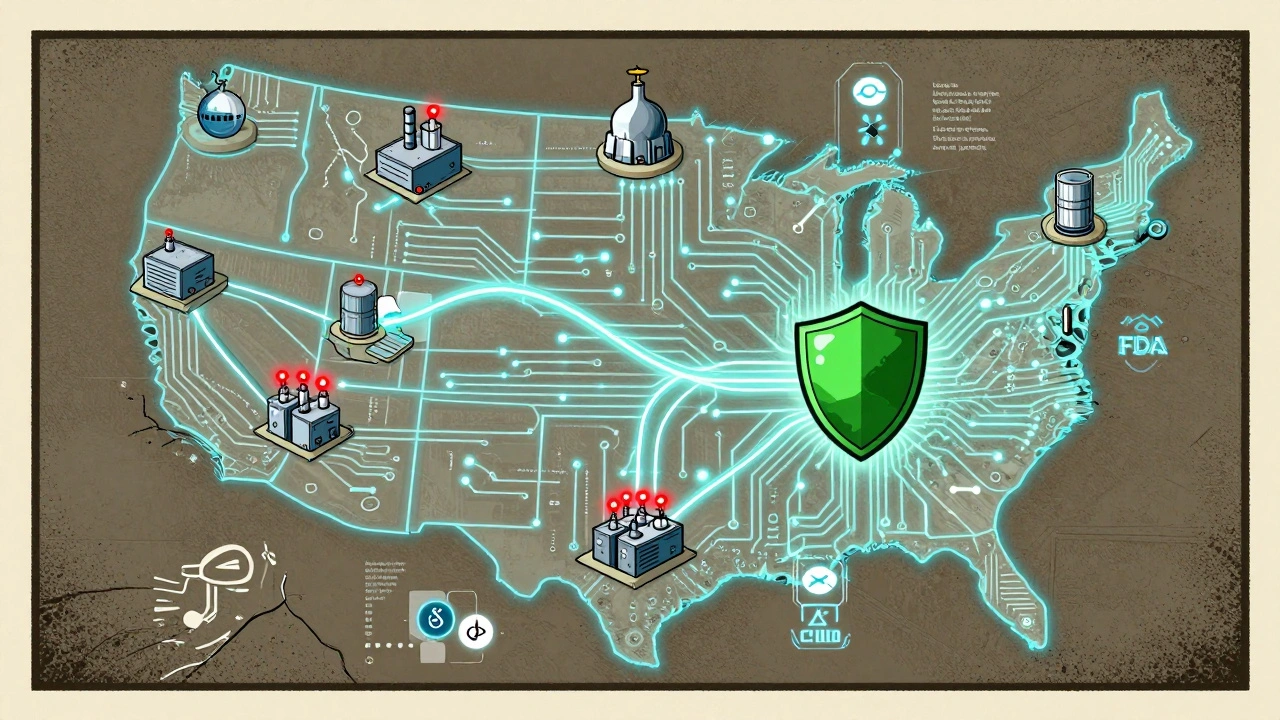

Generic drug manufacturers don’t compete on brand loyalty or marketing. They compete on price. And that’s where things get fragile. When one company slashes its price by 5%, others have to follow-or lose market share. The result? Average EBITA margins have dropped from 12.5% in 2018 to just 8% in 2022. That’s not a business model. It’s a survival mode. But here’s the catch: lower prices mean less room for error. With thinner profits, companies cut back on backup suppliers, safety stock, and redundant manufacturing lines. The outcome? A 73% higher risk of shortages for low-cost generics compared to higher-priced ones. Eighty percent of the world’s active pharmaceutical ingredients (APIs) come from just three countries: India, China, and the U.S. One factory shutdown, one shipping delay, one regulatory inspection-and a life-saving medication vanishes from shelves.What Efficiency Really Looks Like

Efficiency in this space doesn’t mean running lean. It means running smart. The top performers don’t just cut costs-they restructure how they predict, move, and store drugs. Take the Economic Order Quantity (EOQ) model: Q = √(2KD/G). It sounds like math class, but it’s the difference between having 30 days of stock or running out in 3. Leading distributors use this formula to balance ordering costs against storage expenses. The result? A 30-45% drop in stockouts. That’s not luck. That’s precision. Then there’s the Perfect Order Percentage-a metric that multiplies four factors: on-time delivery, complete orders, undamaged goods, and correct documentation. Top distributors hit 95%+. The average? Around 75%. That 20-point gap isn’t just a number. It’s missed prescriptions, frustrated patients, and lawsuits waiting to happen.Technology Isn’t Optional Anymore

Cloud-based ERP systems are now the backbone of efficient distribution. They give real-time visibility across warehouses, trucks, and suppliers. But the real game-changer? IoT sensors on shipping containers. Forty-five percent of generic drugs need strict temperature control. If a shipment hits 30°C for 4 hours, the whole batch is ruined. Sensors alert teams before it happens. No more guessing. AI-powered forecasting is another leap. Traditional methods relied on last year’s sales data. But demand for generics spikes unpredictably-after a flu outbreak, a new FDA warning, or even a viral social media post about side effects. AI tools reduce forecast errors by 25-40%. Teva Pharmaceutical cut inventory costs by 32% after implementing one. McKesson’s new ‘DemandSignal’ platform cut errors by 37% in pilot tests.The Two Models: Just-in-Time vs. Just-in-Case

There are two ways to run a generic drug supply chain: lean or safe. The Efficient Chain Model (just-in-time) is what most companies try to copy. It slashes inventory holding costs by 22-35%. But it also raises stockout risk by 15-20% during disruptions. One manufacturer in India delays an export by two weeks? Suddenly, 50,000 patients can’t get their blood pressure meds. The Responsive Chain Model (just-in-case) keeps extra buffer stock. It increases holding costs by 18-28%, but cuts stockouts by 40-60%. The smartest distributors don’t pick one. They mix them. For high-volume, stable drugs like metformin, they go lean. For critical drugs with volatile demand-like epinephrine auto-injectors or insulin-they keep a 15-20% safety buffer. That’s the secret most overlook.

Who’s Winning and Why

Three companies control 85% of U.S. generic distribution: McKesson, AmerisourceBergen, and Cardinal Health. And they’re pulling away from the pack. Cardinal Health gained 3.2% market share in 2022 after investing $150 million in predictive analytics. Their competitors? Still using spreadsheets and phone calls. The gap isn’t growing-it’s exploding. Top quartile distributors now hit 9.2% EBITA margins. The bottom quartile? Just 6.8%. That’s not a difference in scale. It’s a difference in strategy. The winners all do three things:- They use data to decide what to stock, not guesswork.

- They track performance with OEE (Overall Equipment Effectiveness)-Availability × Performance × Quality. Top players hit 85%+. The industry average? 68-72%.

- They don’t just move drugs-they manage risk. They know which suppliers are single points of failure.

The Hidden Costs of Cutting Corners

Many distributors think efficiency means reducing staff, eliminating safety stock, and squeezing suppliers. But the data says otherwise. A 2023 Supply Chain Dive survey found that 68% of distributors who eliminated all safety stock faced severe shortages within a year. One manager on LinkedIn said, “We cut inventory to save $2 million a year. Then we lost $15 million in lost sales and patient trust.” And then there’s the human cost. When a hospital runs out of a generic antibiotic, patients get transferred. Delays happen. Complications rise. In some cases, people die. That’s not a supply chain problem. It’s a public health failure.Regulations Are Making It Harder-And Better

The FDA’s Drug Supply Chain Security Act (DSCSA) requires full electronic traceability of every drug package by 2023. The EU’s Falsified Medicines Directive does the same. These rules add 5-10% to operational costs. But they also force transparency. Before, a distributor couldn’t tell if a shipment came from a legitimate factory or a rogue lab. Now, every box has a digital ID. That reduces counterfeit drugs-and increases trust. It’s not a burden. It’s a baseline.

What’s Next: Digital Twins and 99% Service Levels

By 2027, the best distributors will operate with digital twins of their entire supply chain. Think of it as a live, virtual copy of every warehouse, truck, and factory. It simulates disruptions before they happen. Can we handle a hurricane in Texas? A labor strike in India? A sudden surge in demand for a new generic? The digital twin answers in minutes. MIT predicts these systems will cut inventory costs by 50% and boost forecast accuracy to 95%+. Service levels will hit 99%+. The companies that get there will dominate. The ones that don’t? They’ll be bought-or disappear.How to Start Improving Today

You don’t need a $150 million budget to start. Here’s what actually works:- Start with demand forecasting. Replace old Excel sheets with a simple AI tool. Even basic ones reduce errors by 20%.

- Identify your top 10 critical drugs. Keep a 15% buffer on each. Don’t cut it.

- Track your Perfect Order Percentage. If it’s below 85%, you’re losing money.

- Connect your warehouse to your sales data. Real-time visibility is non-negotiable.

- Don’t chase the lowest price from suppliers. Chase reliability. One reliable supplier beats three cheap ones.

Final Thought: Efficiency Is Not Cheapness

Efficiency in generic drug distribution isn’t about paying less. It’s about doing more with less-without breaking the system. The cheapest drug in the world is useless if no one can get it. The future belongs to distributors who treat their supply chain like a lifeline-not a cost center. Because when a patient needs a pill, they don’t care about your margin. They just need it to be there.Why are generic drug shortages so common?

Generic drug shortages are common because manufacturers operate on extremely thin profit margins, leading them to cut back on backup suppliers, safety stock, and redundant production lines. With 80% of active pharmaceutical ingredients (APIs) coming from just three countries, any disruption-like a factory shutdown, regulatory issue, or shipping delay-can cause widespread shortages. Low-priced generics are 73% more likely to run out than higher-priced ones because there’s no financial buffer to absorb delays.

What is the Economic Order Quantity (EOQ) model and how does it help?

The Economic Order Quantity (EOQ) model is a formula-Q = √(2KD/G)-that calculates the optimal order size to minimize total inventory costs, balancing ordering expenses against storage fees. In generic drug distribution, using EOQ helps companies avoid overstocking (which ties up cash) and understocking (which causes shortages). Leading distributors using this model report 30-45% fewer stockouts and better cash flow without increasing warehouse space.

Is just-in-time inventory safe for generic drugs?

Just-in-time (JIT) inventory reduces storage costs by 22-35%, but it’s risky for generics. With only one or two manufacturers for many essential drugs, JIT leaves no room for delays. A 2023 survey found that 68% of distributors who eliminated all safety stock faced severe shortages within a year. The smart approach is hybrid: use JIT for stable, high-volume drugs like metformin, but keep a 15-20% buffer for critical, volatile drugs like epinephrine or insulin.

How do AI and IoT improve generic drug distribution?

AI improves demand forecasting by analyzing real-time data like hospital prescriptions, weather events, and social trends-not just past sales. This cuts forecast errors by 25-40%. IoT sensors track temperature, humidity, and location during transport. Since 45% of generics need climate control, these sensors prevent spoilage before it happens. Together, they reduce waste, avoid shortages, and ensure patients get safe, effective medication.

What’s the difference between efficient and responsive supply chains in generics?

An efficient supply chain focuses on low cost and high volume, using standardized processes and minimal inventory. It’s great for stable drugs like metformin. A responsive supply chain prioritizes flexibility, keeping extra stock and multiple suppliers to handle sudden demand spikes. It’s better for critical, unpredictable drugs. Top distributors use both: efficient for routine items, responsive for essentials. Trying to use only one model leads to either high costs or dangerous shortages.

Why do some distributors still use outdated systems?

Many smaller distributors still use legacy systems because upgrading costs $2.5-4 million and takes 6-9 months to integrate with old software. There’s also resistance to change and lack of in-house analytics skills. But the cost of inaction is higher: distributors using outdated tools are losing market share to tech-savvy competitors. The gap is widening-top performers now have 2.4 percentage points higher profit margins than laggards.

Can regulatory requirements like DSCSA help improve efficiency?

Yes. The FDA’s Drug Supply Chain Security Act (DSCSA) requires full electronic tracking of every drug package. While it adds 5-8% to operational costs, it forces transparency, reduces counterfeits, and improves traceability during shortages. Distributors who embraced it early now have better data for forecasting and faster responses to recalls. What was once seen as a burden is now a competitive advantage.

Let’s cut through the fluff: if you’re not using EOQ with real-time IoT telemetry and AI-driven demand signals, you’re not a distributor-you’re a liability. The 73% higher shortage risk for low-margin generics isn’t a bug, it’s a feature of incompetent capital allocation. We’re talking about life-or-death supply chains running on Excel sheets while China controls 52% of APIs. This isn’t economics. It’s national security failure dressed in lean operations jargon.

There is a quiet wisdom in the hybrid model-lean for metformin, buffer for epinephrine. It mirrors the ancient Indian principle of 'Dharma' in action: do what is necessary, not what is easy. The system does not demand perfection, only balance. To cut safety stock is to forget that medicine is not a commodity-it is a covenant with human life. The math is clear, but the ethics must guide it.

so like… we’re paying $0.02 for a pill but the guy who ships it needs a $150M AI system to not run out? sounds like capitalism’s version of a soap opera. also why is everyone acting like ‘digital twins’ are magic? i’ve seen a warehouse manager use duct tape and a prayer and get 95% perfect orders. maybe we’re overengineering the crisis?

Let me be perfectly clear: the entire structure of generic drug distribution is a grotesque parody of modern capitalism. We have reduced life-saving pharmaceuticals to a zero-sum auction where the lowest bidder wins-and the patient loses. The fact that we celebrate ‘efficiency’ while hospitals scramble for insulin is not innovation-it’s moral bankruptcy dressed in ERP software. The digital twin isn’t the future-it’s the last gasp of a system that has forgotten its soul. And yes, I am furious.

My grandma takes metformin. She doesn’t care about EOQ or IoT sensors. She just needs it to be there. If we’re talking about efficiency, maybe we start by listening to the people who actually use these drugs-not just the supply chain analysts. A 15% buffer isn’t waste. It’s dignity.

As someone who’s lived in three countries, I’ve seen how supply chains break differently everywhere. In India, it’s power outages. In the US, it’s ‘profit first’ thinking. But the human cost is the same: someone misses a dose, gets sick, and the system shrugs. We need to stop treating medicine like widgets. This isn’t just logistics-it’s global health justice.

It is my professional opinion, grounded in decades of regulatory compliance and supply chain governance, that the continued reliance upon manual forecasting methodologies constitutes a breach of fiduciary duty to public health stakeholders. The absence of integrated digital traceability protocols is not merely suboptimal-it is indefensible under the principles of the DSCSA. I urge all stakeholders to immediately cease reliance upon antiquated systems and embrace full electronic pedigree compliance without exception.

the 95% perfect order thing? yeah that’s nice. but what about the 5% that aren’t? someone’s kid misses their asthma med because of a typo in a barcode. that’s the real story.

Of course the Chinese and Indian manufacturers are the backbone-because we outsourced our entire industrial base to save a few cents. And now we’re shocked when the system collapses? Wake up. This isn’t a supply chain issue. It’s the direct result of 40 years of neoliberal policy. Stop blaming spreadsheets. Blame the CEOs who shipped the factories overseas for a 2% quarterly gain.

What struck me most is how many of these solutions are already in use by small, community-based distributors who never had the budget for AI-but had the heart to care. They called suppliers personally. They kept extra stock in their basements. They didn’t need digital twins. They needed trust. Maybe the real innovation isn’t in the tech-it’s in remembering that people, not algorithms, keep medicine flowing.

Let me be blunt-the entire generic drug supply chain is a monument to American economic cowardice. We have the technological capacity to build self-healing, AI-driven, blockchain-secured, IoT-monitored, climate-resilient, multi-sourced, redundancy-optimized pharmaceutical ecosystems-but we choose instead to outsource everything to low-wage economies and then cry when the lights go out. This isn’t efficiency. This is strategic surrender disguised as fiscal responsibility. The 8% EBITA margins? That’s not a business model-it’s a surrender document.

It’s interesting how we talk about ‘efficiency’ like it’s a neutral term. But efficiency for whom? The shareholder? The patient? The worker in the Indian API plant? Maybe we need to redefine efficiency-not as cost-minimization, but as resilience-in-service. The hybrid model isn’t just smart logistics. It’s ethical design.

I find it deeply troubling that so many commentators are romanticizing the ‘hybrid model’ as if it were some enlightened compromise. In reality, it is a band-aid on a hemorrhaging system. The only true solution is domestic manufacturing. Period. No more outsourcing. No more ‘just-in-case’ buffers. We need full vertical integration. We need a national pharmaceutical reserve. We need to treat medicine like ammunition-not inventory. Anything less is complicity.

I work in a rural clinic. We’ve had patients skip doses because a shipment was delayed. One woman with diabetes went three days without insulin because the distributor said ‘it’s on backorder.’ She ended up in the ER. The tech solutions are great-but they don’t fix the fact that we still treat medicine like a product, not a right. Maybe we need to stop optimizing the supply chain and start rethinking the system.

Let’s be real-90% of this is just corporate speak. EOQ? IoT? Digital twins? Sounds like a consulting deck. The real problem? One factory in India shuts down and suddenly 3 million Americans can’t get their blood pressure meds. That’s not a logistics failure. That’s a monopoly failure. McKesson, Cardinal, AmerisourceBergen control 85% of distribution. They don’t want competition. They want you to think this is a ‘supply chain problem’ so you don’t ask why there are only three players.