Ever picked up your prescription and been shocked that your generic drug cost more than the brand-name version? You’re not alone. It feels backwards-generic drugs are supposed to be cheaper. But in today’s insurance system, that’s not always true. And the reason has nothing to do with the medicine itself. It’s all about the contract between your insurer and the drug maker.

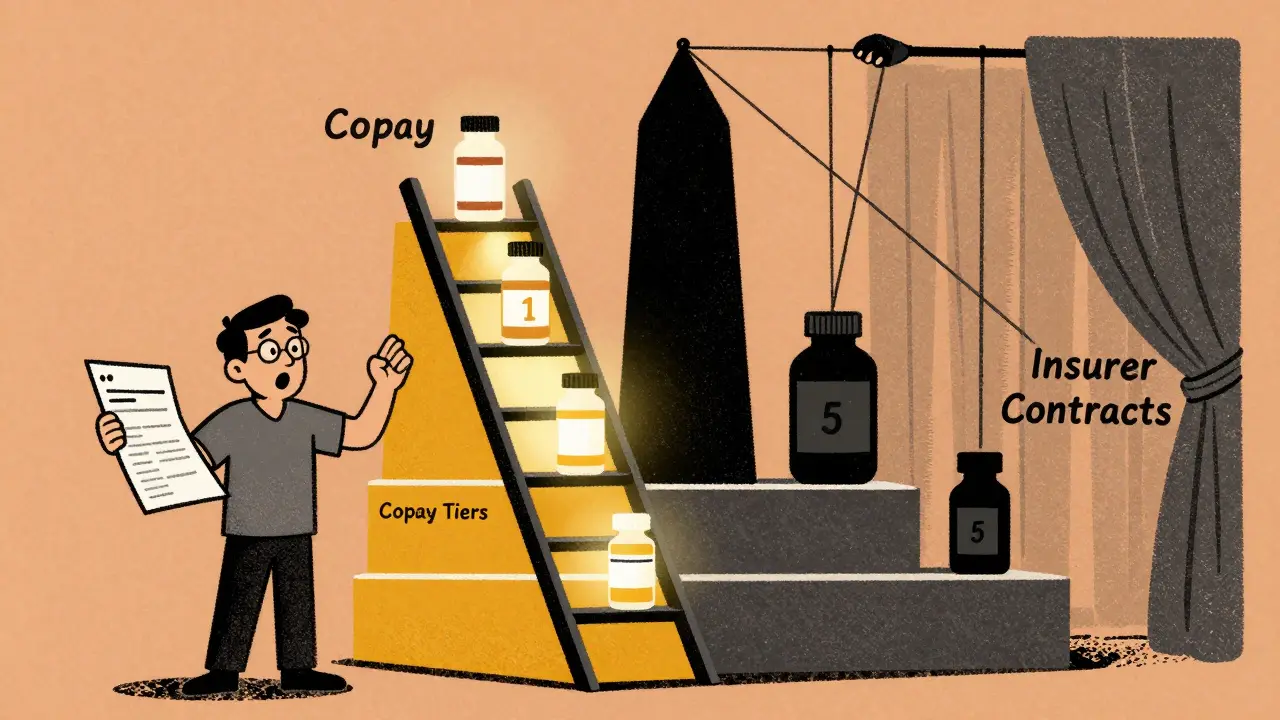

How Tiered Copays Work

Most health plans today use a system called tiered copays. Think of it like a pricing ladder for your prescriptions. Each tier has a different out-of-pocket cost. The lower the tier, the less you pay. Here’s how it usually breaks down:- Tier 1: Preferred generics. Usually $0-$15 for a 30-day supply.

- Tier 2: Preferred brand-name drugs. Around $25-$50.

- Tier 3: Non-preferred brand-name drugs. $60-$100.

- Tier 4 and 5: Specialty drugs. These often require a percentage of the total cost (coinsurance), not a flat fee.

At first glance, this seems fair. You’re rewarded for choosing cheaper options. But here’s the twist: not all generics land in Tier 1. Some-yes, even identical copies of the same medicine-end up in Tier 2 or even Tier 3. And that’s where the confusion starts.

Why Your Generic Isn’t in Tier 1

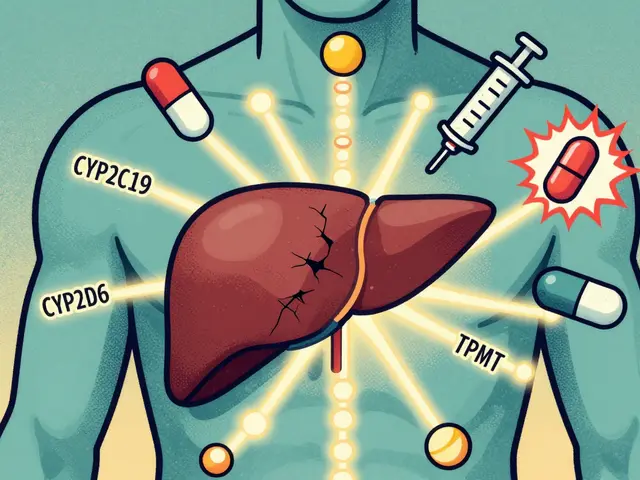

You might assume all versions of a generic drug are treated the same. They’re chemically identical, right? Yes. But insurers don’t care about that. They care about rebates.Pharmacy Benefit Managers (PBMs)-companies like Express Scripts, CVS Caremark, and OptumRx-negotiate deals with drug manufacturers. The manufacturer offers a big discount (a rebate) in exchange for the drug being placed in Tier 1. If another company makes the same drug but didn’t agree to a big enough rebate, it gets stuck in a higher tier-even though it’s the exact same pill.

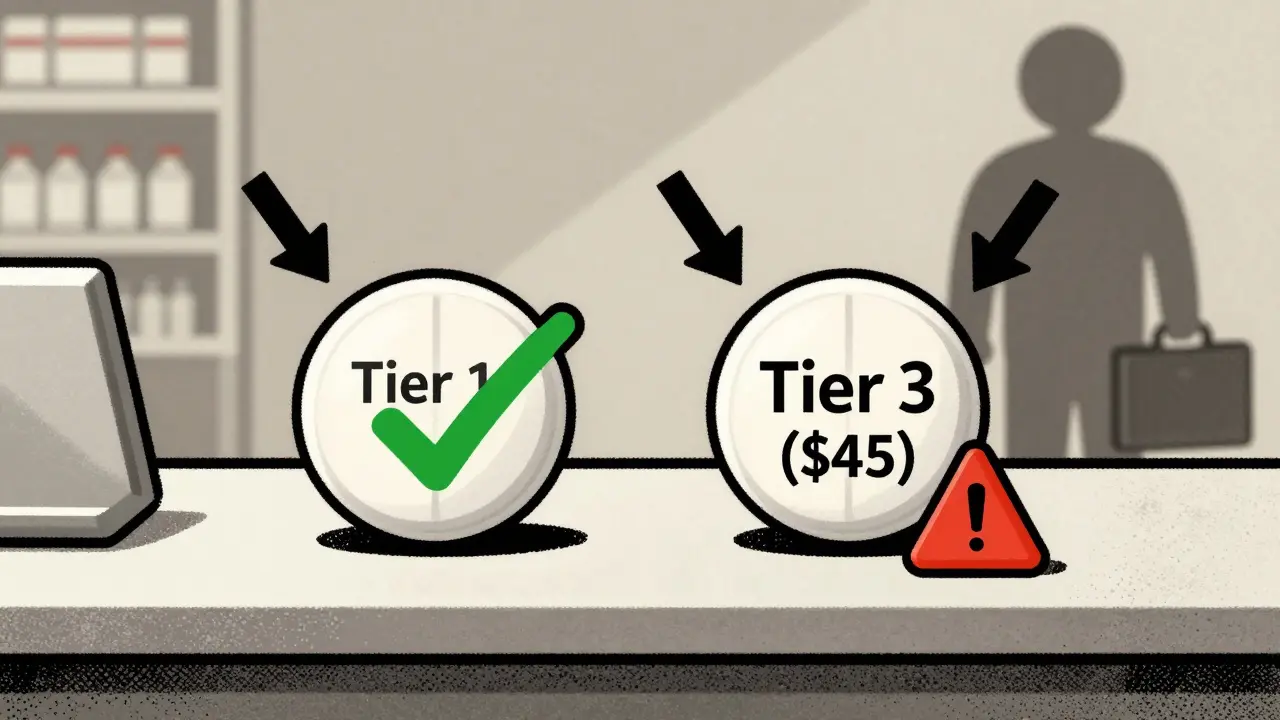

For example, let’s say you take levothyroxine for thyroid issues. There are dozens of generic versions. Your plan might list one brand as Tier 1 with a $5 copay. Another version, made by a different company, is Tier 3 with a $45 copay. Same active ingredient. Same dosage. Same effectiveness. But one costs nine times more just because the manufacturer didn’t cut the same deal with your PBM.

A 2023 analysis by BOC Pharmacy Group found that 12-18% of generic drugs are classified as specialty medications and placed in higher tiers-not because they’re complex, but because they cost more to produce or are used for rare conditions. Some generics cost over $600 a month. Those get pushed into Tier 4 or 5, even if they’re not technically “specialty” drugs.

The Real Culprit: Rebates, Not Results

This isn’t about safety. It’s not about quality. It’s about money.Dr. Dennis G. Smith, former director of the Center for Medicaid and CHIP Services, put it plainly: “Preferred status has nothing to do with clinical superiority-it’s entirely about the rebates and discounts PBMs negotiate with manufacturers.”

That means your plan might switch your generic drug without telling you. One month, you’re paying $10. The next, you’re paying $50. Why? The manufacturer stopped paying the rebate. The PBM moved the drug to a higher tier to push you toward the version that pays them more. You didn’t ask for it. Your doctor didn’t recommend it. But now you’re stuck with the bill.

According to Avalere Health, 68% of generic drugs moved to higher tiers in recent years were due to expired rebate contracts-not because they were less effective or more dangerous.

What This Does to Patients

When patients hit unexpected copays, they skip doses. They delay refills. Some stop taking the drug altogether.A 2005 study in the Journal of the American Medical Informatics Association found that when diabetes meds moved from Tier 2 to Tier 3, adherence dropped by 7.3%. That’s not just a number-it’s people risking heart attacks, strokes, and hospital stays because they couldn’t afford their medicine.

Patients on Reddit and Health Union forums report the same story: “My generic levothyroxine went from $5 to $45 overnight. My doctor said all generics are the same. So why is this one so expensive?”

A 2023 survey by the Patient Advocate Foundation found that 41% of insured adults had faced a higher-than-expected generic copay. Of those, 68% said their insurer gave no clear explanation. That’s not transparency. That’s confusion by design.

How to Fight Back

You don’t have to accept this. Here’s what you can do:- Check your formulary. Every plan updates its drug list every October. Log in to your insurer’s website and search for your medication. Look for the tier. Is it where you expect it?

- Ask your pharmacist. Pharmacists know which generics are preferred. If you get a different pill than usual, ask: “Is this the same drug, just a different brand? And is there a cheaper version?”

- Request a therapeutic interchange. Your doctor can submit a form asking your insurer to cover the generic you’ve been taking-even if it’s not preferred. This works 63% of the time, according to the Medicare Rights Center.

- Use GoodRx or SmithRx. These apps show you cash prices and compare copays across tiers. Sometimes, paying cash is cheaper than using your insurance.

- Apply for manufacturer assistance. Many drugmakers offer coupons or free programs for low-income patients. Even if you have insurance, you might qualify.

What’s Changing in 2025

The Inflation Reduction Act kicks in January 2025. For Medicare Part D users, your out-of-pocket drug costs will be capped at $2,000 a year. That’s huge. But here’s the catch: tiered systems are still allowed. The cap doesn’t change how drugs are categorized. It just limits how much you pay at the end of the year.Meanwhile, some insurers are making changes. UnitedHealthcare started pushing certain high-volume generics like atorvastatin and lisinopril into $0 copays in Tier 1. But they moved less common generics to Tier 2 with $10 copays. So it’s not about lowering costs across the board-it’s about steering you toward the drugs they profit from.

Experts predict that by 2026, most plans will drop from five tiers to four. But the core problem won’t disappear: your generic might still cost more than it should-because of a contract you never saw.

What You Need to Remember

- Generic doesn’t mean cheap. In tiered systems, it means “preferred by your insurer’s contract.” - Same drug, different price. Two identical pills can cost wildly different amounts based on who made them. - Your doctor doesn’t control this. They prescribe based on health. Your insurer decides the cost. - You have power. Ask questions. Use tools. Appeal decisions. Don’t assume it’s normal.If you’re paying more for a generic than you should, it’s not your fault. It’s a system designed to save money for insurers-not for you. But now you know how it works. And that’s the first step to fixing it.

Why is my generic drug more expensive than the brand-name version?

It’s not about the drug itself-it’s about rebates. Your insurer’s Pharmacy Benefit Manager (PBM) negotiates discounts with drug makers. If one generic manufacturer offered a bigger rebate, their version gets placed in the lowest-cost tier. Another identical generic without that deal ends up in a higher tier, even though it’s the same medicine. The brand-name drug might be cheaper because it’s still under patent protection and your plan has a special deal with that company.

Can my insurer change my generic drug without telling me?

Yes. Insurers update their formularies every year, usually in October. They can move a drug to a higher tier at any time if the manufacturer stops paying the rebate. Sometimes, your pharmacy will automatically switch your prescription to a preferred generic without asking you. That’s called a therapeutic interchange. You might not notice until you see the higher copay at the counter.

How do I find out which tier my drug is on?

Log into your insurer’s website and look for the “formulary” or “drug list.” Search for your medication by name. It will show you the tier and your copay. If you’re on Medicare, check your plan’s annual Notice of Change letter. You can also use free tools like GoodRx or SmithRx to compare prices and tiers across plans.

What’s the difference between preferred and non-preferred generics?

There’s no clinical difference. Both contain the same active ingredient, dosage, and strength. The terms “preferred” and “non-preferred” are purely financial. Preferred generics are the ones whose manufacturers agreed to give the biggest rebate to your insurer’s PBM. Non-preferred generics didn’t, so they cost you more-even though they work the same way.

Can I appeal if my drug is moved to a higher tier?

Yes. You can file a formulary exception request through your insurer. Your doctor needs to write a letter explaining why you need the specific generic you’re currently taking-for example, because you’ve had side effects with others or your condition is stable on this version. These appeals are approved 63% of the time, according to the Medicare Rights Center. Don’t assume it’s hopeless-ask.

Are there any new rules that will help lower generic drug costs?

Starting in 2025, Medicare Part D will cap your annual out-of-pocket drug costs at $2,000. That’s a big win. But it doesn’t change how drugs are tiered. It just means you won’t pay more than that total, no matter how many high-tier drugs you take. For private insurance, there’s no federal cap yet. Some states are pushing for transparency laws, but for now, the system still rewards insurers for steering you toward drugs that pay them the most-not the ones that cost you the least.

I had no idea generics could be priced like this. My levothyroxine jumped from $8 to $42 last month and my doctor just shrugged. I thought it was a mistake until I checked my formulary-turns out the manufacturer stopped paying rebates. I’m paying more for the exact same pill. This system is broken.

THIS IS WHY I HATE AMERICA. You get sick, you need medicine, and the system still finds a way to screw you. I saw a guy on the street crying because he couldn’t afford his insulin. Same damn thing. They’re making a business out of your suffering. I’m done.

Don’t let them make you feel powerless. I fought my insurer for 3 months after they switched my generic. I called, I emailed, I had my doctor write a letter, and I used GoodRx to show them the cash price was lower. They finally relented. You have rights. Use them.

Of course this is happening. PBMs are just middlemen owned by the same banks that run your insurance. It’s a pyramid scheme disguised as healthcare. The whole system is designed to extract wealth from the sick while pretending to help. They don’t care if you die-they care if the rebate check clears. Wake up.

It’s not just the rebates-it’s the grotesque commodification of human biology. You’re not a patient; you’re a data point in a financial algorithm. The fact that two identical pills cost nine times more based on corporate negotiations is not capitalism-it’s dystopian theater. And we’re all just applauding from our seats.

So… just pay cash? Why does everyone make this so complicated? I use GoodRx and my $45 generic is $12 cash. I don’t even use insurance anymore. 🤷♀️

In my home country, generic drugs are regulated to be priced within 10% of each other regardless of manufacturer. It’s not about rebates-it’s about equity. The U.S. system turns healthcare into a market game, and patients are the ones losing. We need policy change, not just personal hacks.

While the emotional appeal of this piece is understandable, one must consider the economic structure underpinning pharmaceutical distribution. The current tiered system incentivizes efficiency and cost containment within a fragmented payer landscape. To eliminate tiering without addressing underlying rebate dynamics would merely shift costs to premiums or reduce formulary breadth. The issue is not moral failure-it is structural misalignment. A holistic reform must address PBM transparency, manufacturer pricing power, and insurer risk-sharing mechanisms simultaneously. Emotional narratives, while compelling, do not constitute policy solutions.

Just last week I had the same issue with my blood pressure med. I asked my pharmacist for the cheapest option, and they gave me a different brand. I didn’t realize it was the same drug until I checked the bottle. Now I always check the NDC number. Simple, but it saves me $30 a month. Small steps matter.