When your doctor prescribes a brand-name medication and your insurance denies coverage, it’s not just a paperwork hiccup-it can threaten your health. Many people assume generics are always just as good, but for some conditions, the brand-name version is the only option that works. If your insurer says no, you have rights. And you can win. This isn’t about fighting big companies-it’s about using the system the way it was meant to be used.

Why Insurance Denies Brand-Name Medications

Insurance companies don’t deny brand-name drugs because they’re mean. They do it because of formularies-lists of drugs they agree to cover. These lists change often, sometimes with no warning. A drug you’ve been on for years might suddenly be removed, replaced by a cheaper generic. But here’s the catch: generics aren’t always interchangeable. For medications like insulin, epilepsy drugs, or biologics for autoimmune diseases, even small differences in formulation can cause serious side effects or treatment failure. In 2022, the Centers for Medicare & Medicaid Services found that 63% of prior authorization denials were for brand-name drugs. That’s not random. It’s policy. Insurers assume generics will work for everyone. But if you’ve tried them and they didn’t work-or made you sicker-your case is different.Your Legal Rights Are Stronger Than You Think

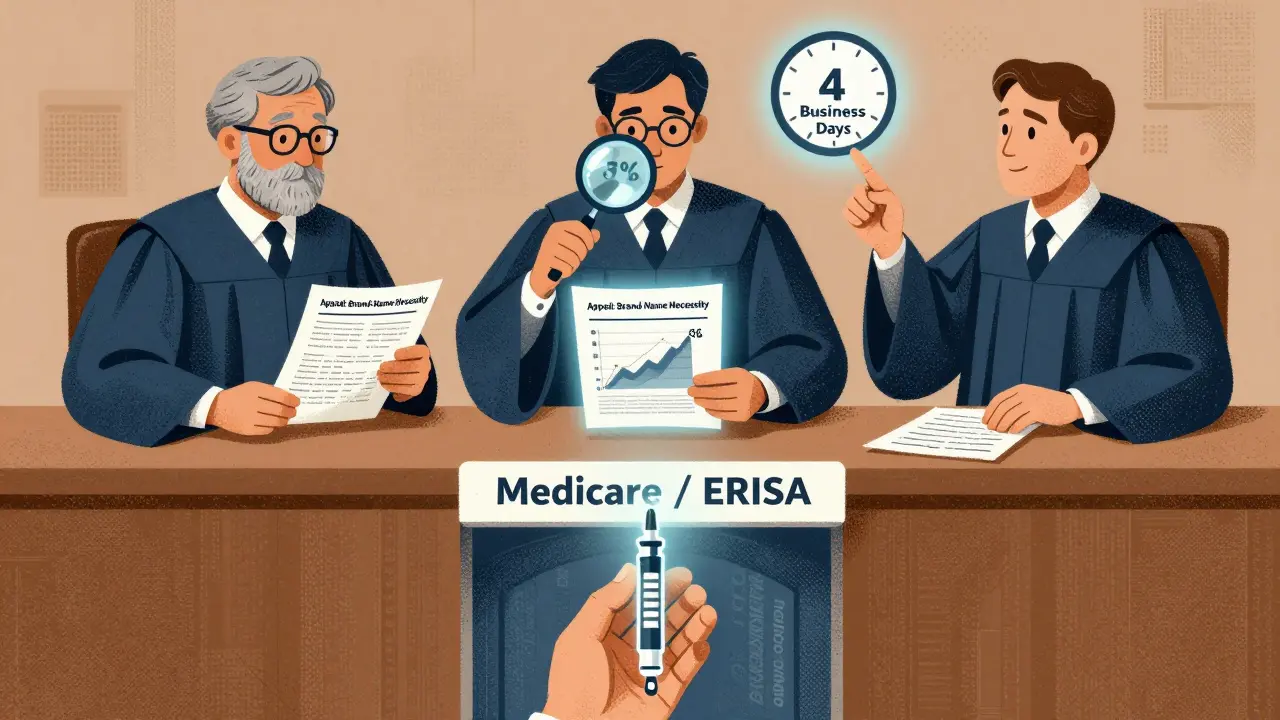

Under the Affordable Care Act, you have a legal right to appeal. The process has two steps: internal and external review. Internal means you appeal directly to your insurance company. External means an independent third party reviews your case. You must go through internal first, but don’t assume that’s the end. External reviews succeed in 58% of brand-name medication cases, according to the National Association of Insurance Commissioners. That’s more than half. If your plan is through your employer, it’s likely governed by ERISA-a federal law that limits your ability to sue. But it also requires insurers to follow strict timelines. They must send you a written denial within 15 days. If you’re already taking the medication, they have 60 days to respond to your appeal. For urgent cases-like insulin dependence or seizure control-they must decide in 4 business days. Some states, like New Zealand’s equivalent regulations, require even faster responses.The One Document That Changes Everything

You won’t win this without a letter of medical necessity from your doctor. Not a note. Not a form. A full letter. GoodRx analyzed over 1,200 appeal cases and found this letter was the single biggest factor in approval. It needs to include:- Your exact diagnosis

- Specific names of generic alternatives you’ve tried

- What happened when you took them (side effects, worsening symptoms, hospital visits)

- Why the brand-name drug is medically necessary

- How your quality of life improves on this medication

How to Start the Appeal

Step 1: Read your Explanation of Benefits (EOB). It must list the exact reason for denial. Look for phrases like “not medically necessary,” “formulary restriction,” or “generic alternative available.” Write this down. Step 2: Call your doctor’s office. Ask for the letter of medical necessity. Tell them you’re appealing a denial. Most offices have templates. If they resist, say: “I need this to avoid hospitalization.” That gets results. Step 3: Submit your appeal in writing. Use Healthcare.gov’s recommended format: patient name, policy number, denial date, reason for denial, clinical justification, and request for coverage. Send it certified mail or via portal with a receipt. Don’t rely on email. Step 4: Call the insurance company every 3-5 days. Ask for your appeal’s status. Kantor & Kantor’s data shows appeals with follow-up calls are processed 28% faster. Keep a log: who you spoke to, when, and what they said.What to Do If the Internal Appeal Fails

If your insurer says no again, move to external review. Who handles it depends on your plan:- For non-ERISA plans (individual, Medicaid, Medicare Advantage): Contact your state’s insurance commissioner’s office.

- For ERISA plans (employer-sponsored): File with the U.S. Department of Health and Human Services.

Real Stories That Show It Works

One man in Hamilton, New Zealand, appealed a denial for his daughter’s brand-name insulin. She had severe lows on generics. His doctor’s letter listed her ER visits and glucose logs. The insurer approved coverage within 11 days. Another patient, on a brand-name migraine drug, was denied for two years. He finally hired a lawyer. The appeal succeeded after proving the generic caused seizures. He paid $2,500 in fees-but avoided $18,000 in hospital bills. GoodRx found that 78% of successful appeals involved active doctor participation. Only 22% worked when patients went alone. Your doctor isn’t just a signature-they’re your strongest ally.

Help Is Out There

If this feels overwhelming, you’re not alone. A 2022 Patient Advocate Foundation survey found 61% of people felt lost in the appeals process. You don’t have to do it alone.- Ask your pharmacy if they have an appeals coordinator.

- Check if your drug manufacturer offers patient assistance programs. Eli Lilly’s Insulin Value Program has helped over 1.2 million people while they wait for appeals.

- Contact the Patient Advocate Foundation-they offer free case management.

What to Avoid

Don’t wait. Delays hurt your case. The longer you go without medication, the harder it is to prove medical necessity. Don’t accept “no” as final. Internal denials are just the first round. Don’t skip the letter. Even if your doctor is busy, insist on a full letter. Generic phrases won’t cut it. Don’t assume your insurer is right. Many denials are based on outdated formularies or flawed assumptions about generics.What’s Changing in 2026

The Biden administration’s 2023 Executive Order pushed CMS to simplify external reviews. The 2023 Consolidated Appropriations Act now requires Medicare Part D plans to show real-time coverage info before prescriptions are written-cutting denials by 15-20%. AI tools are being rolled out to flag inappropriate denials. But ERISA plans still move slowly. The bottom line: Brand-name medications aren’t luxury items. For thousands, they’re lifelines. The system is stacked against you, but it’s not broken. You have the tools. You have the rights. Use them.What if my insurance says a generic is just as good?

Insurance companies often assume generics are interchangeable, but that’s not true for all drugs. For medications like insulin, epilepsy treatments, or biologics, even small differences in inactive ingredients can cause serious side effects or treatment failure. You need to prove this with clinical records-lab results, hospital visits, or documented reactions to the generic. A detailed letter from your doctor showing prior failures is key.

How long do I have to appeal a denial?

You have up to 180 days from the date of denial to file an internal appeal for most private plans. Medicare gives you 120 days. Medicaid timelines vary by state. For urgent cases, you can request expedited review, which must be decided within 4 business days. Don’t wait until the last minute-appeals take time to process.

Can I get help paying for the medication while I appeal?

Yes. Many drug manufacturers offer patient assistance programs that provide free or low-cost medication during the appeal process. For example, Eli Lilly’s Insulin Value Program has helped over 1.2 million people access brand-name insulin while waiting for coverage decisions. Your pharmacy or doctor’s office can help you apply. These programs are designed to prevent treatment interruptions.

Why do some appeals take months?

Delays happen because insurers are overwhelmed. In 2023, UnitedHealthcare reported a 22% increase in prior authorization requests. Physicians now spend over 13 hours a week managing these requests. If your appeal lacks clear documentation, it gets sent back for more info. That adds time. To avoid delays, submit a complete appeal with your doctor’s letter, diagnosis codes, and proof of prior treatment failures.

Do I need a lawyer to win an appeal?

Not always, but it helps. Kantor & Kantor found that appeals drafted by attorneys succeed 47% more often than those filed by patients alone. This is especially true for ERISA-governed plans, where insurers use legal tactics to delay or deny. If your case is complex, involves hospitalization, or has been denied twice, consider legal help. Many nonprofit legal aid groups specialize in health insurance appeals and work on contingency.